More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you — email us at info@axialvc.com

Ionis Pharmaceuticals was founded in 1989 to translate antisense technologies into drugs. In 1998, the company earned its first drug approval with fomivirsen (with Novartis) to treat cytomegalovirus retinitis (CMV) in immunocompromised patients. The next 10 years or so were pretty tough for Ionis and the entire antisense oligonucleotide (ASO) field - first generation chemical backbones were not stable enough or induced severe immune reactions in patients. In 2016, Spinraza was approved by the FDA to treat spinal muscular atrophy (SMA). The company developed the drug with Biogen, and since then Ionis has been rapidly growing its pipeline and positioning itself as one of the leaders in the ASO field, over 30 years since founding.

The first slide of their latest corporate presentation gives an overview on Ionis - a moat around ASO IP and a whole lot of cash.

The next slide goes into the company’s vision to expand the scope of ASOs and transition from a discovery business model to a commercial one.

The key milestones for 2021 are launching new products, bringing assets through the clinic, and expanding the platform.

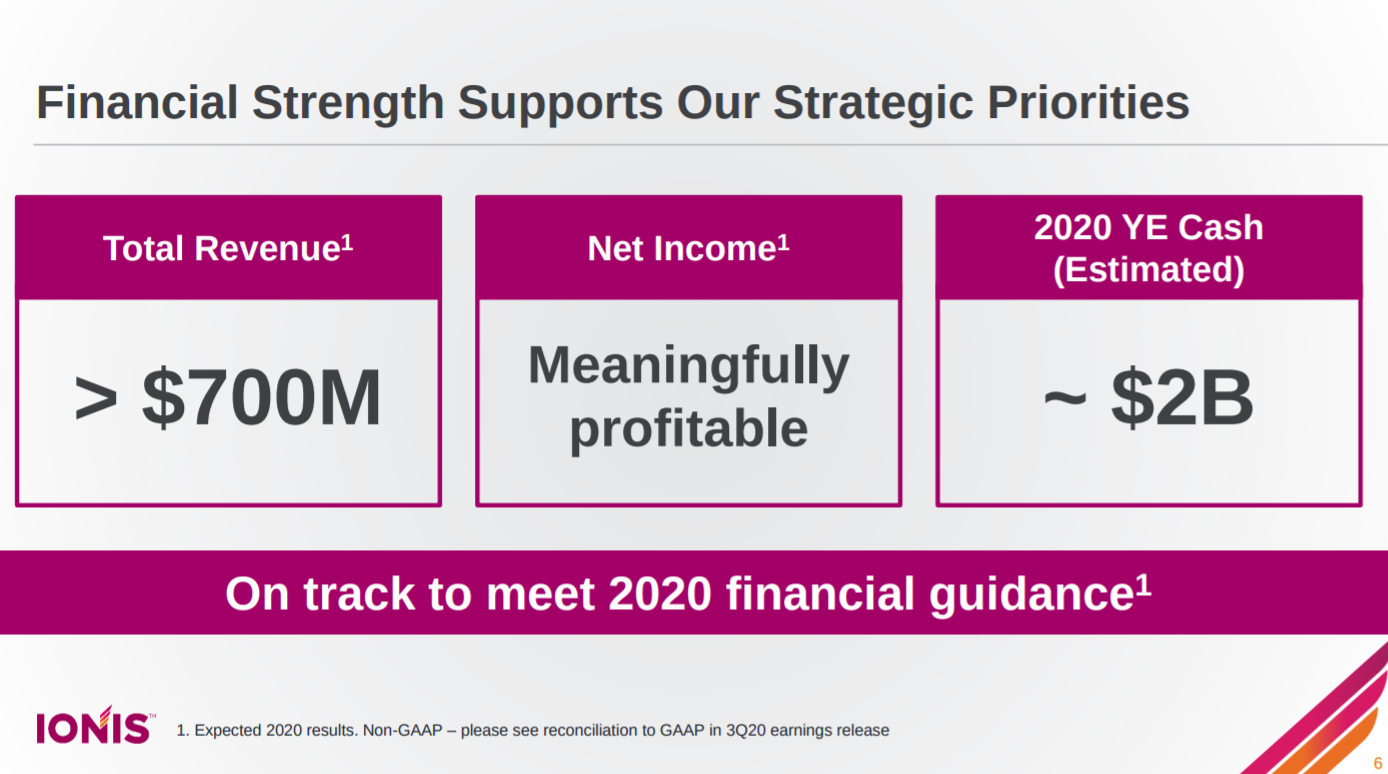

This slide gives a financial overview on Ionic. Pretty good spot relative to where Ionic was in the 2000s.

Ionis has a wide purview on the diseases they can address.

In CNS, Ionis uses this slide to show their product line - approved and clinical drug candidates.

Ionis uses a similar slide for their cardiovascular product line.

The company brings the last 2 slides together with this table. Pretty good track record so far and a lot of assets coming down the pipe.

After giving a broad overview on disease focus, Ionis describes their phase 3 drug candidates with their indications, patient population, and data readout date.

This slide highlights their CNS phase 3 assets.

For Tofersen, Ionis gives an overview on ALS. The company is pursuing a subpopulation where SOD1 is a hallmark.

This slide shows the major trials and drug candidates in ALS - in short, they are pursuing all 3 major subtypes. This broad approach is enabled by the ASO modality. An upfront investment in the beginning allows for the cost to be amortized over time across more trials within the same tissue/organ.

Ionis’ lead asset in ALS, Tofersen, targets SOD1 and is the company’s most mature clinical asset.

Within CNS, Ionis provides an overview on Huntington’s Disease. Unlike ALS, the disease has a clear genetic cause - HTT.

The company’s lead asset in Huntington’s Disease, Tominersen, which is focused on reducing HTT expression levels.

Next Ionis goes into their phase 3 drugs in cardiovascular disease.

The next slide is an overview on ATTR, caused by a mutation in the transthyretin (TTR) gene, in particular its prevalence.

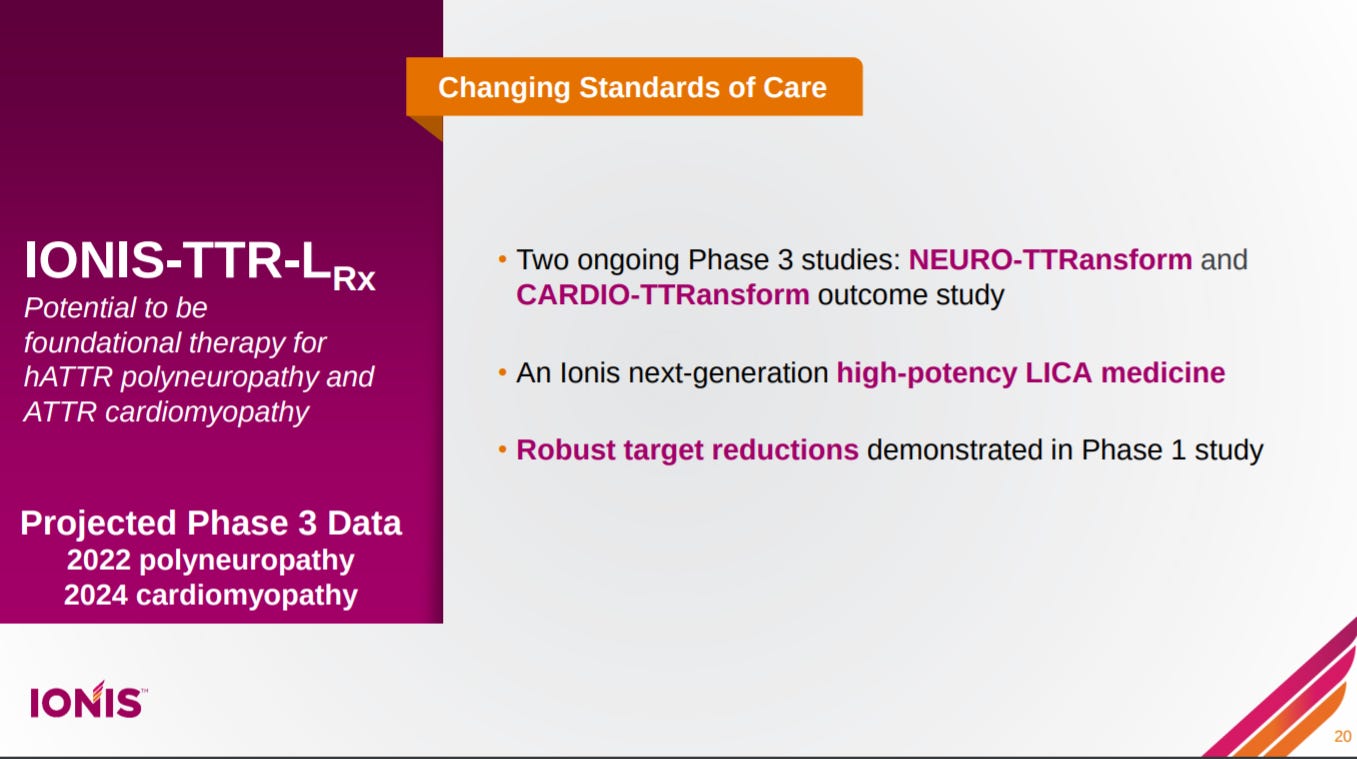

Their lead asset in ATTR, reabsorbed through Akcea in a great deal and a product of its next-generation ASO technologies, focuses on reducing expression levels of mutant TTR.

Ionis gives another overview on diseases driven by elevate triglycerides.

Describes their lead asset in the indication.

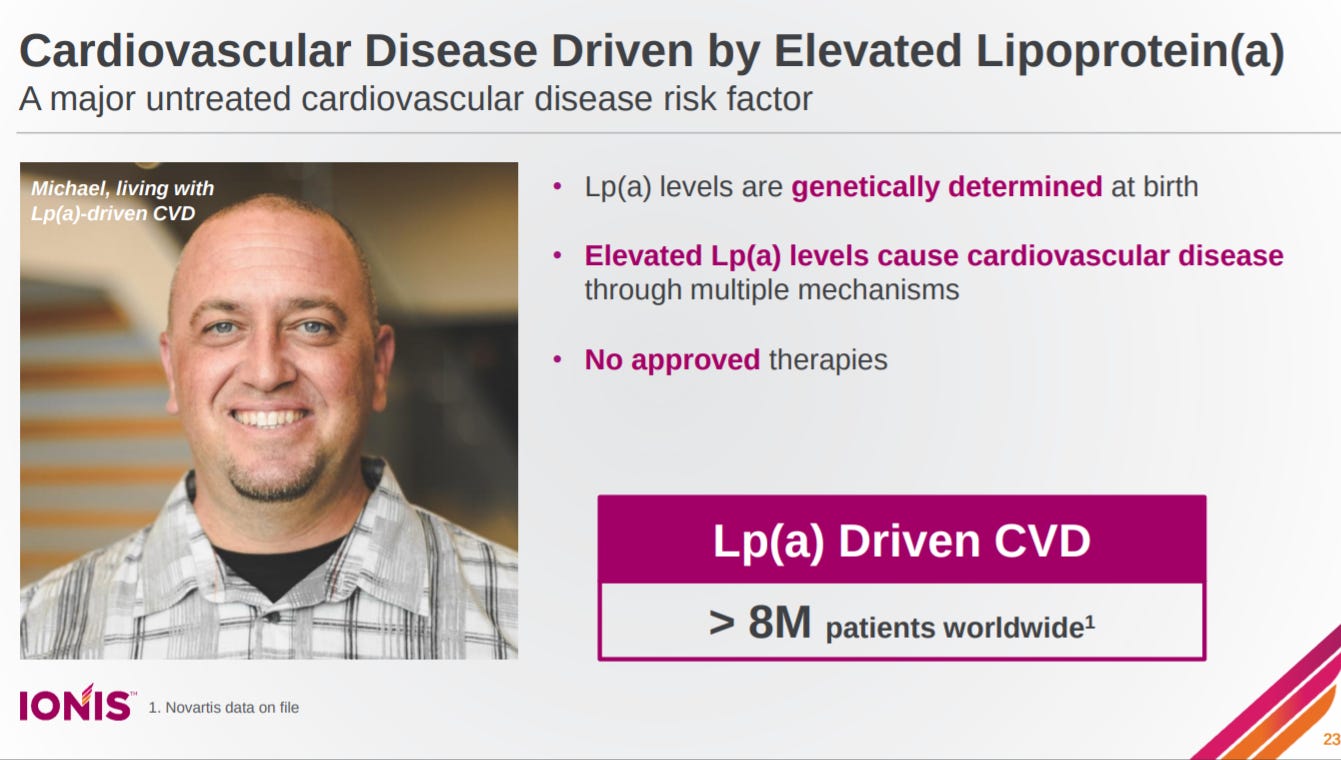

Does the same overview for elevated Lp(a).

And with a pretty exciting lead asset in Lp(a) that reduces apolipoprotein(a) in the liver.

Ionis wraps their part of the presentation with the slide on their phase 3 drugs again.

Ionis’ goal is to move from licensing deals to wholly-owned assets. They spent ~30 years to validate the modality. The next 5 years will be focused on driving as many approved products they can.

Near the end, Ionis describes the advantages of ASOs - once the chemistry of the backbone is figured out, it’s as easy as changing the sequence.

This is an ASO overview - with 3 mechanisms: inhibition of expression, upregulation, splicing inhibition.

Ionis’ next-generation technologies are centered around their Ligand Conjugate Antisen (LICA) platform. Essentially, a ligand is conjugated to an ASO and enables it to have more selective delivery through receptors that are specific to the ligand.

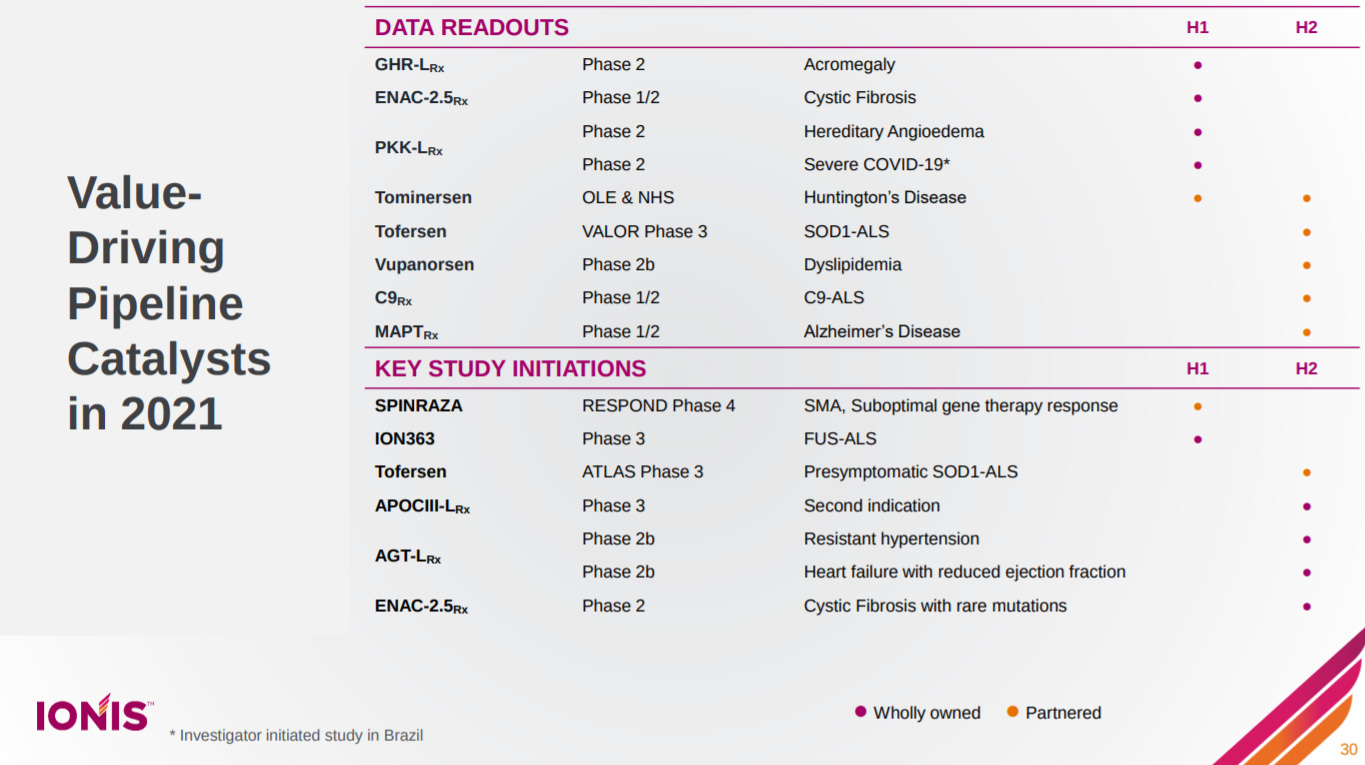

Ionis has a ton of catalysts this year. Pretty amazing.

The company ends the presentation with a overview on their strengths.

Ionis’ presentation shows how broad an impact ASOs can have. The company has been through a lot of ups and downs; it would be great to convey that somehow. But Ionis has some of the best tools to design new ASOs. That platform is paying off now with a wide array of approved and late-stage clinical assets. They are realizing the potential of antisense technologies - another company might do something similar combining ASOs with genomics and machine learning.

Follow up questions for the team:

The Akcea deal was incredibly valuable to Ionis - what was the driver to buy the remaining stake? Any push back?

Any progress on Ionis’ target discovery engine? For something like ALS, maybe the company could initiate programs to find new genetic drivers?

Updates on the company’s kidney disease programs with AstraZeneca?