Deck Review with Zymeworks

Surveying great inventors and businesses

More well thought out work can be found at — https://axial.substack.com/

Axial partners with great founders and inventors. We invest in early-stage life sciences companies often when they are no more than an idea. We are fanatical about helping the rare inventor who is compelled to build their own enduring business. If you or someone you know has a great idea or company in life sciences, Axial would be excited to get to know you and possibly invest in your vision and company . We are excited to be in business with you — email us at info@axialvc.com

Zymeworks develops multifunctional biologics for cancer, autoimmunity, and inflammatory diseases. Founded in 2004 by Ali Tehraniafter earning a PhD in microbiology at the University of British Columbia, the company originally was pursuing industrial enzymes and validated its protein engineering platform in this field. Zymework is a very early case study of a company starting up focused on merging technology and biology. An important differentiator for Zymeworks was focusing on modeling protein dynamics in a solvent (not in isolation as most academic labs were doing at the time). However, Ali Tehrani shifted toward a more promising market - new medicines not wanting to build a “coffee shop.” Sixteen years later, Zymeworks has their lead asset, ZW25, in a pivotal trial for HER2+ biliary tract cancer with a strong pipeline and several partnerships.

The first slide of their latest corporate presentation lays out Zymeworks’ leading role in developing multi-functional therapeutics and vision to become a fully-integrated drug company.

The company goes into its pipeline of clinical and preclinical products.

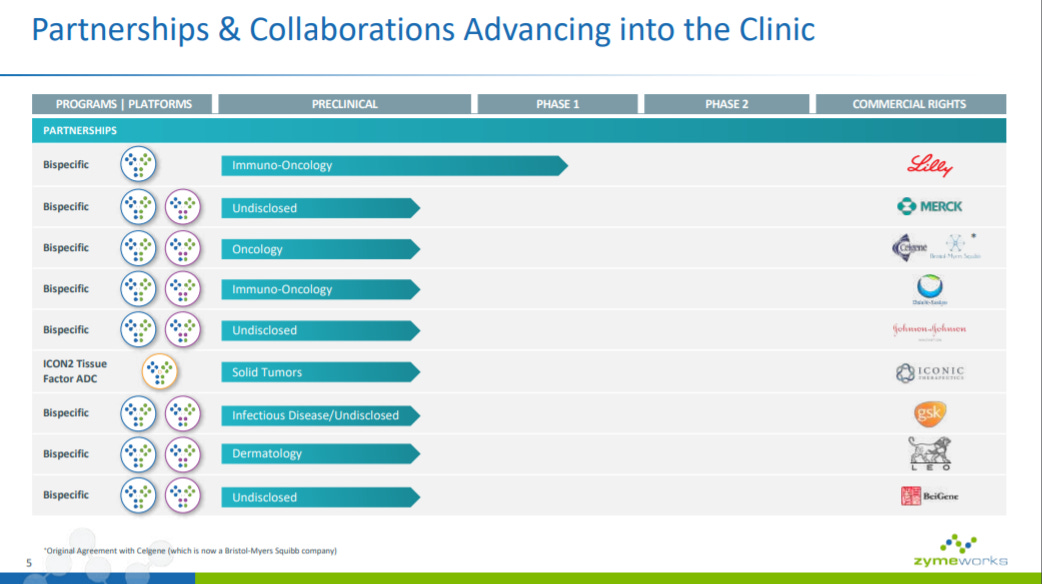

Zymeworks then maps out its partnerships. Pretty impressive.

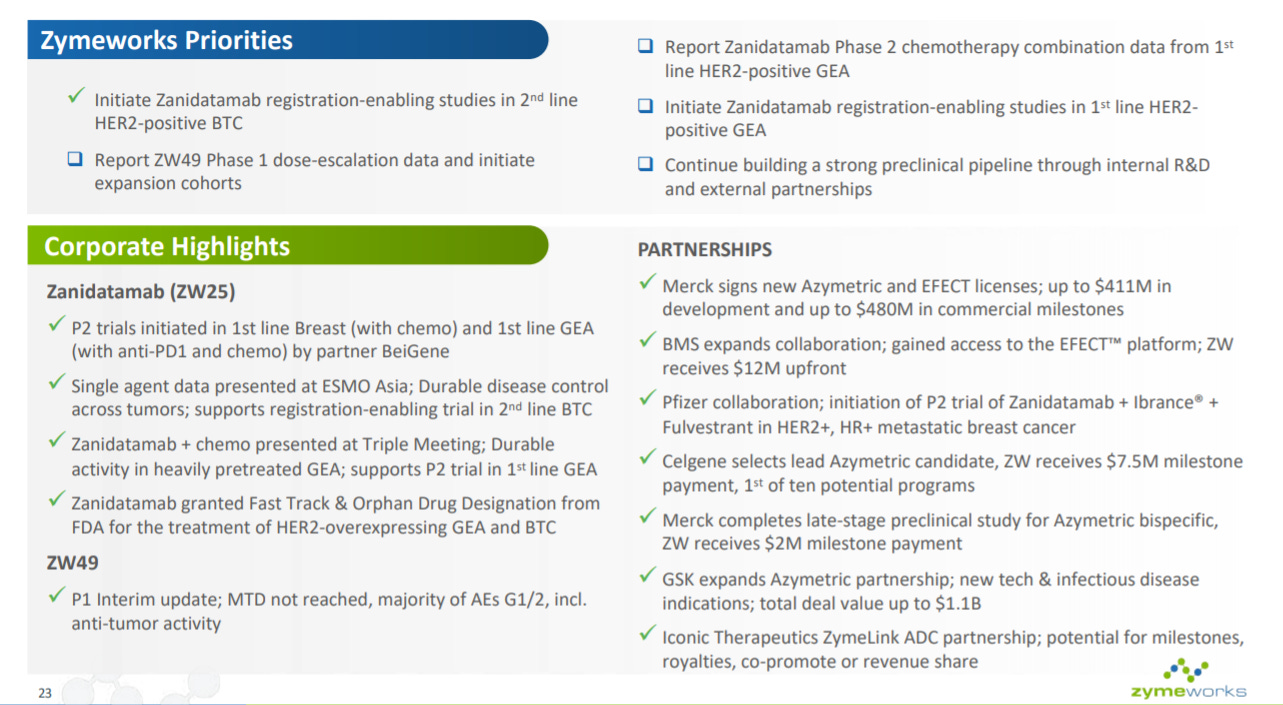

This is a really important slide of economics for these partnerships. Some controversy amongst public investors recently was the upfront payments from the Merck deal expansion was in the hundreds of thousands of dollars not millions as expected.

Insteading of discussing their technology then going into their pipeline, Zymeworks flips it. The next slide lays out their 3 platforms:

Azymetric - bispecifics

ZymeLink - linkers for biologics (i.e. ADCs)

EFECT - Fc engineering

Zymeworks started off on building out its process and focused on the premise of using software to make biologics development cheaper (impacting costs) and faster (impacting lives). Their platform was built to “enable new biologies” and overtime their process of biologics design has led to products. An important point for Zymeworks was their early ability to only use non-exclusive licenses for their platform.

Then Zymework lays out what its platform can enable: (1) multiple designs (2) multiple functions. Another part of the technical vision for Zyemewokrs is going from a computer/in vitro models to a human.

The company describes how their platform enables a fully integrated business model. Zymeworks could be a licensing business similar to Adimab or a spinout model similar to F-Star, but Zymeworks is conveying on this slide that they want to own the majority of their products.

With this business model, Zymeworks describes their lead assets - ZW25 (bispecific) and ZW49 (ADC), both HER2 targeting biologics.

By targeting HER2, Zymeworks is taking on the behemoth in the field: Herceptin, the standard-of-care for most breast cancer patients.

Versus Herceptin, Zymeworks is framing ZW25’s advantage through market expansion for HER2+ cancer beyond breast cancer.

With the market expansion story, Zymeworks is going beyond breast cancer and conveying advantages over Herceptin by ZW25’s ability to target HER2+ high and low expressing cancer.

The marketing framing leads Zymeworks to describe the clinical candidate’s advantages: targeting two HER2 epitopes and enhancing internalization/cytotoxicity.

The next slide describes their lead asset’s mechanism. By targeting two HER2 epitopes, ZW25 has enhanced receptor clustering leading to higher binding and internalization versus Herceptin.

Zymeworks finally gets into the clinical data for ZW25 in the most well-developed indication - second-line biliary tract cancer.

And clinical data in gastroesophageal adenocarcinoma (GEA).

For GEA, ZW25 combined with chemo sees pretty promising response/remission rates.

With promising data for ZW25, the company describes their clinical plan for their lead asset to 2023 (projected approval for the first indication) across several types of cancer. The ultimate goal is for ZW25 to become a front line therapy similar to Herceptin.

Zymeworks’ other lead asset ZW49 is described: targeting HER2+ cancers with a similar mechanism as ZW25 but delivering a toxin to increase cytotoxicity.

In HER2+ cell lines, Zymeworks shows great internalization of ZW49 versus a Herceptin/ADC comparable as well as higher cytotoxicity likely driven by move toxin accumulating in the cells.

In preclinical xenograft models, the company shows decreases in tumor volume and increases in model survival for ZW49 versus controls.

To tie the slides on their pipeline, platform, and assets together, Zymeworks uses an overview slide to convey their key focus right now: ZW25 for second line biliary tract cancer and executing the phase 1 trial for ZW49. This is similar to a milestones/catalyst slide albeit Zymeworks wants to show they have accomplished most of their goals.

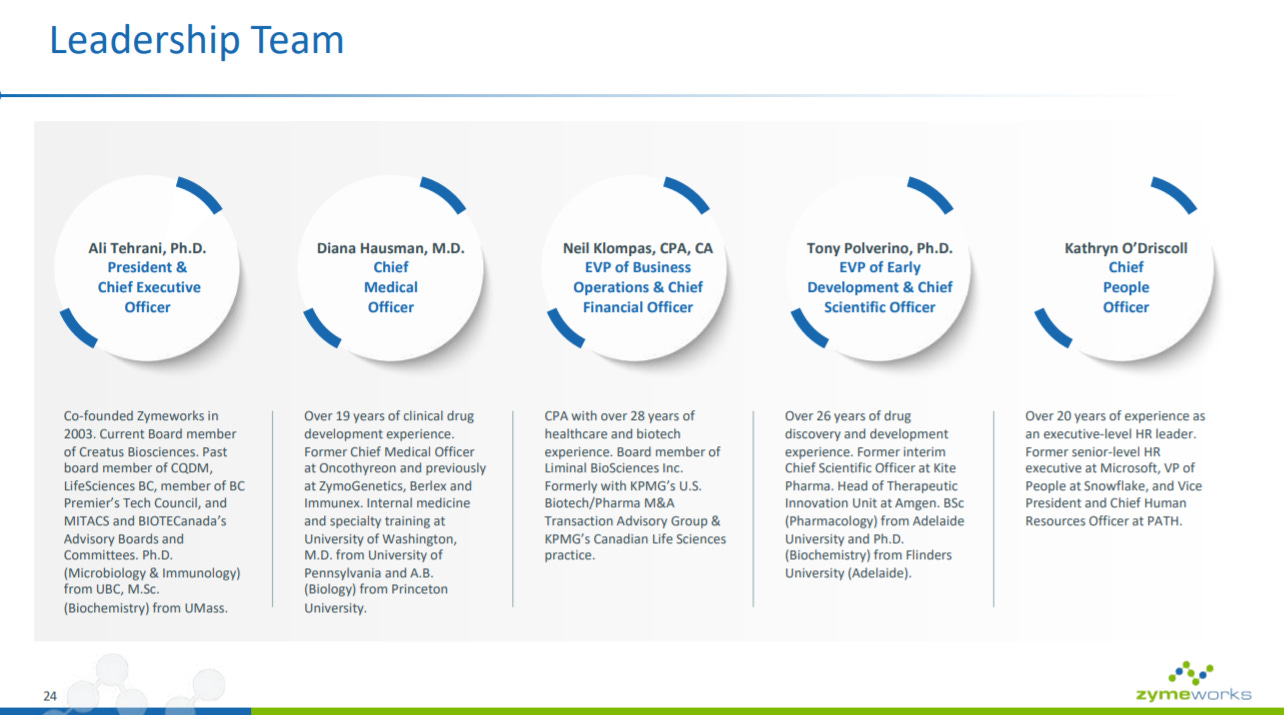

The company describes their executive team. Ali is an incredible life sciences founder.

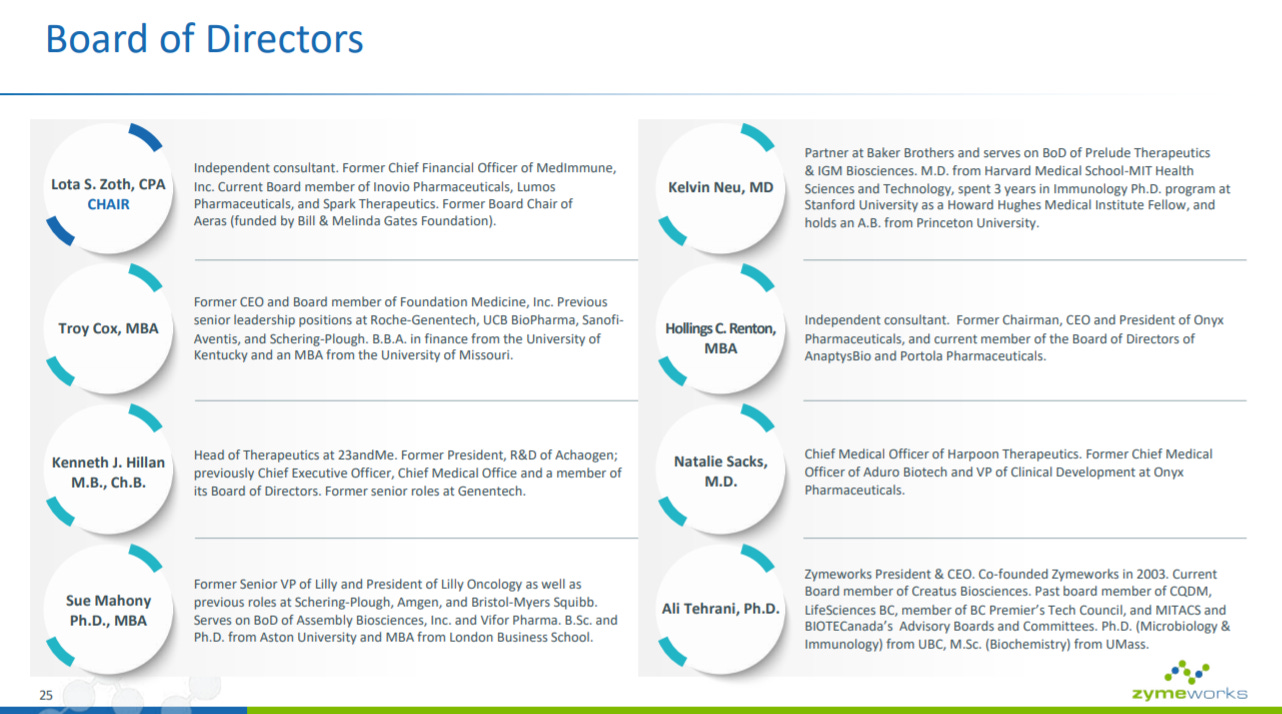

The final slide is on Zymeworks’ board of directors.

The cadence of the deck makes sense in context of Zymework’s founding story - the company started off as a platform business and has now evolved, after 16 years, into a product-focused drug company. What’s exciting about Zymeworks is the upcoming data releases for ZW25 across more and more indications. The medicine has the potential to be a next-generation Herceptin.

Follow up questions for the team:

How are resources allocated to partnerships? What percentage of the employee bases are focused on this work? Technical and BD split?

What is the revenue potential for ZW25 in 2nd-line biliary tract cancer?

From a clinician’s perspective, what will be required for ZW25 to usurp Herceptin as a front-line medicine for HER2+ breast cancer?